For Companies

The Evolution of the BDIndex: a Timeline

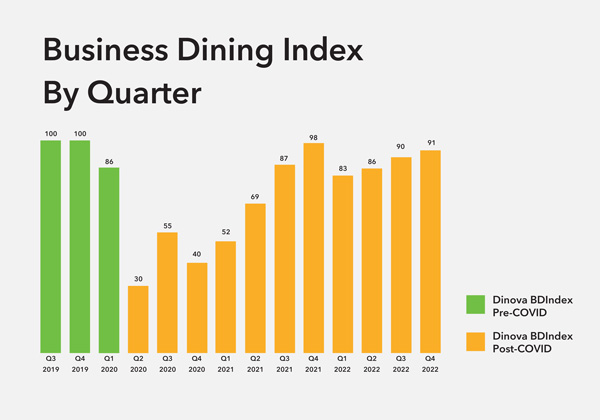

Tracking business dining spend from Q2 2020 to now.

After decades of stability, the restaurant industry was among the hardest hit during the pandemic, forced to quickly adapt everything from their service models to seat spacing and customer flow. During the “unprecedented” upheaval, it often seemed there were more questions than answers. Restaurants needed insights and solutions to understand the evolution of diners’ behaviors and what to expect.

Since the state of business dining speaks volumes about the health of the restaurant industry as a whole, we developed a new way to track business dining recovery after the fallout: the BDIndex (Business Dining Index). Partnerships with more than 500 companies give us unique visibility into $11B of business dining spend; the BDIndex uses cardholder data to measure current business dining spend against the same period in 2019. When BDIndex reaches 100, business dining has fully recovered.

We’ve been tracking the BDIndex, in conjunction with Technomic’s consumer dining recovery measurement, for three years in our State of Business Dining reports. Here’s how it has evolved.

2020: Business Dining Nosedives Amid COVID Shutdowns

In Q2 2020, both consumer and business dining bottomed out as people everywhere took precautions. Consumer dining (measured by Technomic’s metric) dropped to 66% of 2019 levels.

But business dining was hit much harder. Companies, sharply focused on safety and “duty of care,” swiftly shuttered their offices, canceled travel, and swapped in-person meetings for virtual ones. With far fewer corporate catering orders, business trips, meetings, and conferences driving business dining demand, the BDIndex plummeted to just 30 in Q2.

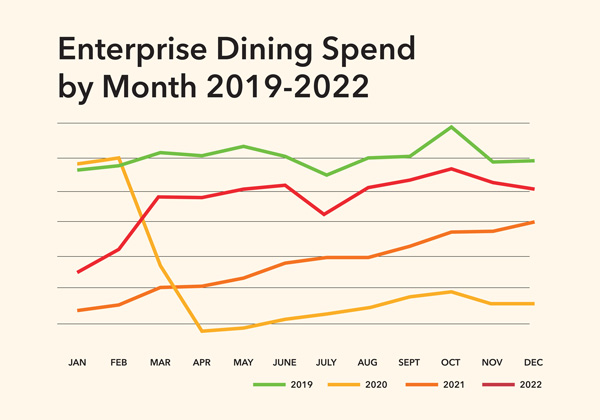

As restaurants adapted operations and adopted new safety measures, consumer dining recovered more quickly and reached 87% by Q4. The BDIndex, however, only reached a high of 55 in Q3 before contracting to 40 in Q4 as businesses continued to exercise caution. Business dining fared better for small businesses than enterprises with more remote work capabilities, and “essential” industries like healthcare and utilities dined at higher rates.

2021-2022: BDIndex Climbs as Businesses and Restaurants Adapt

By 2021, vaccines were becoming widely available. Hospitalizations fell, and despite the appearance of new COVID variants, business dining recovered along with increased optimism that the worst of the pandemic had subsided. Driven largely by increased travel, the BDIndex steadily recovered throughout the year, nearly tripling between Q1 2021 (when it was at 52) and Q4. Meanwhile, consumer dining met or surpassed 2019 spend in every quarter after Q2 2021.

While consumer dining soared, corporate diners were less resilient to COVID’s continued impacts. The BDIndex retracted in Q1 2022, likely due to safety-conscious attitudes among companies after a holiday season filled with travel and in-person visits.

But other business dining behaviors began to look more “normal” in 2022. After becoming more dispersed and defying pre-COVID seasonal trends in 2020 and 2021, seasonal and geographic patterns returned that year.

As signs of normalcy materialized, an increase in corporate meeting spend signaled continued recovery for the BDIndex. Meanwhile, inflation and economic uncertainty threatened to hinder consumer restaurant spending.

2023 and Beyond: Approaching a New Normal?

With the COVID state of emergency officially expiring in May, the worst of the pandemic (and its dragging effects on business dining) are in the rearview. It’s yet to be seen whether the BDIndex will fully recover to 100 or if we’re approaching a new benchmark with hybrid work remaining commonplace.

Either way, we expect business dining to be a significant revenue source for restaurants in 2023, especially as recent studies signal a pullback in consumer spending. Unlike consumers, business diners are less inflation sensitive. After all, beyond sustenance, business meals are an investment in relationships and culture. While consumers increasingly trim their dining out budgets and seek coupons, many companies are increasing their meeting and event budgets.

We’ll be keeping an eye on other emerging trends, like corporate sustainability and DE&I pacts, that could impact continued BDIndex growth in the US as well as where corporate card-holding employees choose to dine.

Q1 | 2023

State of Business Dining Report

Want more exclusive business dining insights? Download our free State of Business Dining Report.