For Restaurants

Corporate catering is booming. Here’s where the biggest opportunities are.

As businesses increasingly prioritize relationship-building and employee engagement post-COVID, catering purchases have soared.

Dinova’s proprietary corporate cardholder data indicated that large purchases (over $250) now comprise over a third of all business dining transactions, a 32% increase over 2019. This was driven largely by the push for more in-person work and the return of large conferences and events.

Demand for catering services is expected to increase—to the tune of $103B by 2027. While corporate catering made up about a quarter of catering companies’ revenue in 2022, it is now the most significant growth driver, recently surpassing weddings. Business catering should be a strategic focus area for restaurants, especially as inflation strains consumer budgets. To maximize profit potential, restaurants should understand the nuances of catering patterns and preferences.

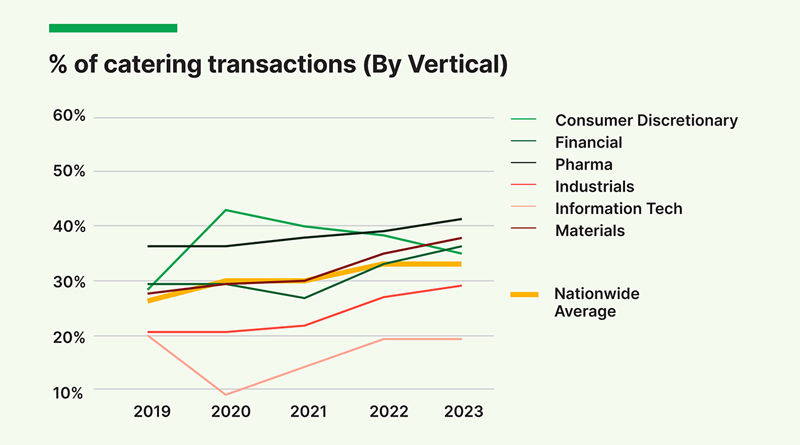

Our latest State of Business Dining Report uses the latest Dinova business dining data and Technomic’s consumer insights to analyze the corporate catering market by region and sector, with exclusive tips on appealing to decision-makers. While nearly all industries have seen an increase in large transactions, a deeper look reveals specific trends to watch.

The pharmaceutical industry is a major driver of catering transactions.

Advances in medical science are expected to drive growth in the “Big Pharma” industry; S&P Global predicts healthy revenue growth through 2027. Complimentary meals have long been a business relationship-building tradition in the industry, allowing sales reps to access busy, hard-to-reach customers.

Today, over 41% of pharmaceutical transactions are catering orders. Since 2019, Technomic 1500 pharmaceutical companies’ have increased their percentage of catering orders in many large markets, including Houston, Chicago, Los Angeles, San Francisco, and Washington, D.C.

> Tip: Focus on providing on-time, accurate delivery, easy ordering, and convenient packages like bundles. Pharma reps typically ask for staff recommendations, so providing leave-behinds like magnets or menus can help keep your restaurant top-of-mind.

Remote and hybrid work patterns largely influence catering sales.

Business dining overall has recovered to 98% of pre-COVID levels. While office occupancy is nowhere near what it was then—hovering around 50% nationwide—many industries and markets are pushing workers to return to their offices. Almost a third (28%) of workplace leaders use free meals to incentivize and build culture, and some large employers are using catering to replace onsite cafeterias that shuttered during COVID.

Top catering markets based on Dinova’s proprietary corporate cardholder, dining spend data

On average, catering’s share of business dining transactions has increased about 7% since 2019, with Atlanta seeing the largest share (45%). But in New York City, where occupancy rates have historically lagged behind other metro areas, catering comprises only 25% of business dining purchases.

Cities with a heavy presence in the pharmaceutical, materials, and financial industries will likely see more corporate catering activity and growth, as these industries spend more dining dollars on catering than the national average (32%).

> Tip: Stay informed about hybrid and remote work trends in your region(s) and any return-to-office announcements from major employers. Remember that hybrid work has upended pre-COVID workday patterns, with more employees opting to work from home on Fridays and in the office mid-week.

Meeting and event recovery means ample opportunities.

As of June 2023, the top 25 meeting and event markets were 90% recovered compared to 2019; 2023 also saw global meeting spend increase 65%. With this resurgence of large-scale events comes the need for more catering — from pre-conference breakfast spreads to drinks and canapés for networking hours. Since 60% of full-service catering orders are for events with 100 or more attendees, this is a huge revenue opportunity for surrounding restaurants.

Knowland predicted that 23 of the top 25 event markets will achieve 100 percent or greater recovery by 2024. In its latest report, Knowland announced that the Tampa-St. Petersburg area saw the most meeting and event growth of all top 25 markets; others in the top 5 included Denver, Boston, Nashville, and Las Vegas. Associations and education were the leading industries driving the growth.

> Tip: Monitor large conferences and events planned in your area. Focus on appealing to event planners by streamlining the booking process, offering a clear value proposition, providing business-friendly amenities, and promoting menu options for special diets.

Spring 2024

State of Business Dining Report

Download the free Spring 2024 State of Business Dining Report for more exclusive insights and tips.